What is a Currency Strength Chart?

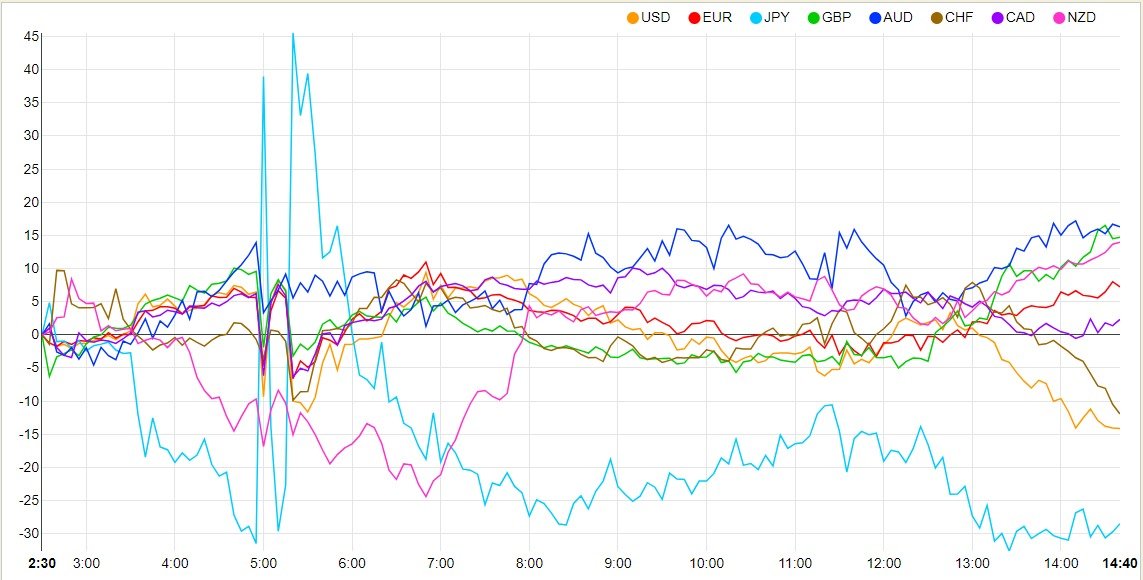

A Currency Strength Chart is a powerful tool for forex traders, providing a visual representation

of the strength of individual currencies. You can explore two key conditions using this chart:

1.Volatility of a Pair

2. Direction of a Pair

A Currency Strength Chart is a visual representation that compares the relative strength or

weakness of different currencies against each other in the foreign exchange (Forex) market. It

provides traders with a quick and clear overview of how individual currencies are performing

relative to others over a specified period.

https://currency-strength.com/